India Financial Market Weekly Review: June 1-7, 2025

1. Overall Market Performance: Equities Overview

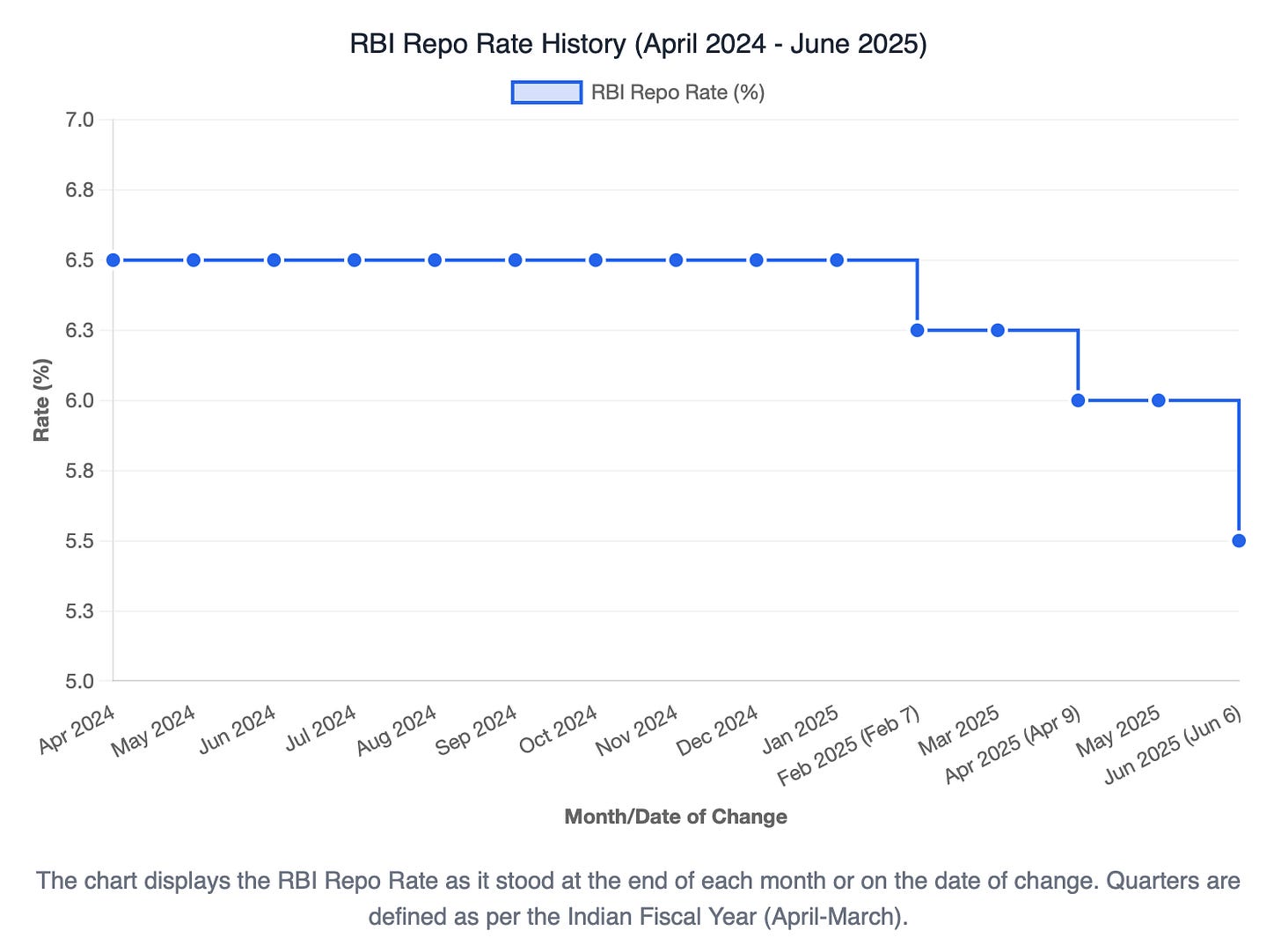

The past week (concluding June 7, 2025) was profoundly influenced by the Reserve Bank of India's (RBI) unexpectedly assertive monetary policy decisions. The central bank implemented a significant 50 basis point (bps) or 0.5% reduction in the repo rate, bringing it to 5.50%, coupled with a substantial 100 bps or 1% cut in the Cash Reserve Ratio (CRR).

Concurrently, the RBI recalibrated its policy stance from 'accommodative' to 'neutral'. This decisive, growth-oriented pivot, aimed at bolstering economic activity amidst global uncertainties, catalyzed a sharp and broad-based rally across Indian equity markets.

A. Nifty and Sensex Performance

Both the Sensex and Nifty indices concluded the week with gains for the third consecutive week, reflecting robust investor confidence. The market is decisively in an uptrend.

Below is the daily chart of Nifty (key levels marked in red box):

This strong performance was particularly evident on Friday, June 6, following the RBI's policy decisions. Concurrently, the India VIX, a key indicator of market volatility, notably cooled off by 9% on a weekly basis, settling at 14.63.

This reduction in volatility suggests a significant easing of investor anxiety and an increased willingness to take on risk. The simultaneous occurrence of substantial weekly gains in both Sensex and Nifty, coupled with a sharp decline in the India VIX, indicates a profound shift in market psychology.

The market's interpretation of the RBI's aggressive rate cut and Cash Reserve Ratio (CRR) reduction is that the central bank is firmly committed to fostering economic growth and stability. This perception has directly translated into a higher risk appetite among investors. Remember that a lower VIX signifies reduced hedging costs and a diminished expectation of large, sudden market movements, thereby encouraging greater participation and investment.

This surge in confidence could serve as a magnet for further domestic and foreign institutional investment, potentially providing a durable foundation for upward momentum in the short to medium term. However, the sustainability of this trend will be contingent upon the effective transmission of the RBI's policy into real economic activity and continued favourable global cues.

Regardless, the RBI's decision to "front-load" a 50 bps rate cut, surpassing the widely anticipated 25 bps, alongside the substantial 100 bps CRR reduction, represents a deliberate move to activate growth and preemptively shield the domestic economy from potential global headwinds, such as those arising from US trade uncertainties.

The shift to a 'neutral' policy stance, while signaling a more measured approach going forward, simultaneously maintains flexibility for future decisions, indicating a dynamic rather than rigid policy framework. The central bank's confidence in easing inflation, particularly in food prices, provided the necessary headroom for this aggressive stimulus.