Union Budget’s Hidden Agenda: The Debt Reduction Plan No One’s Talking About!

How This Fiscal Strategy Could Change India’s Economic Future

As discussed in the previous post, the Union Budget for FY26 was fairly constructive in its approach to fiscal prudence. This is to say that the government has demonstrated its willingness to narrow the gap between its revenues and expenditure.

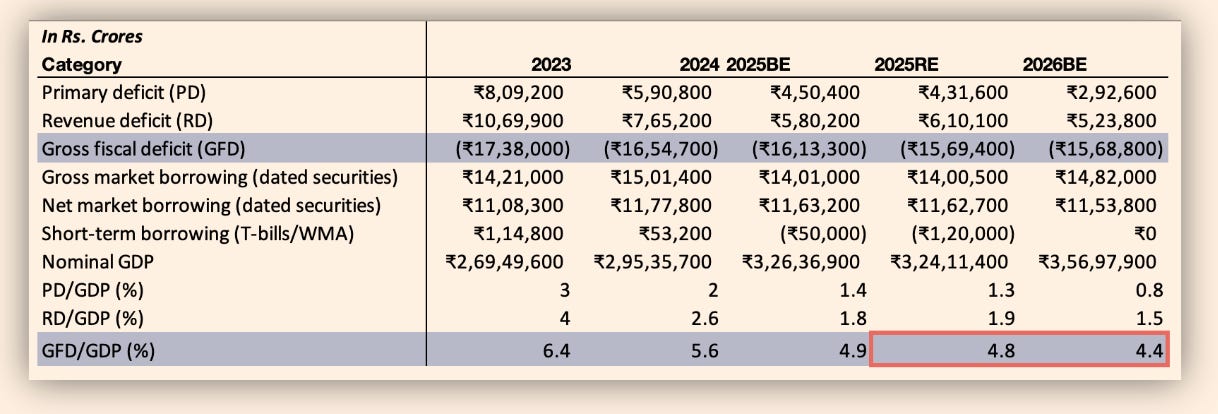

For instance, its fiscal deficit (or the difference between the government’s revenues and expenditures) came in at about 4.8% of India’s GDP in revised estimates of FY25 i.e. from Apr 2024 to March 2025. In FY26 i.e next year, the government has targeted fiscal deficit to narrow down further to 4.4% of the GDP. See the table below.

In fact, every year starting FY27 to FY31, the government has set a goal of reducing the fiscal deficit such that the central government’s debt falls to about 50% (plus or minus 1%) by 31st March 2031. Note that the central government’s current debt-to-GDP ratio is about 57.1%. This doesn’t include the states’ debt, of course. See the chart below.

Now, the question arises, why the goal to reduce government debt? Well, because high debt raises two problems: (1) It increases the interest expenditure of the government, which could have been used instead to create long-term capital assets (think roads, railways, defense, tunnels, dams, and so forth), and (2) It raises broader interest rates in the economy, thus making borrowing expensive for everyone.

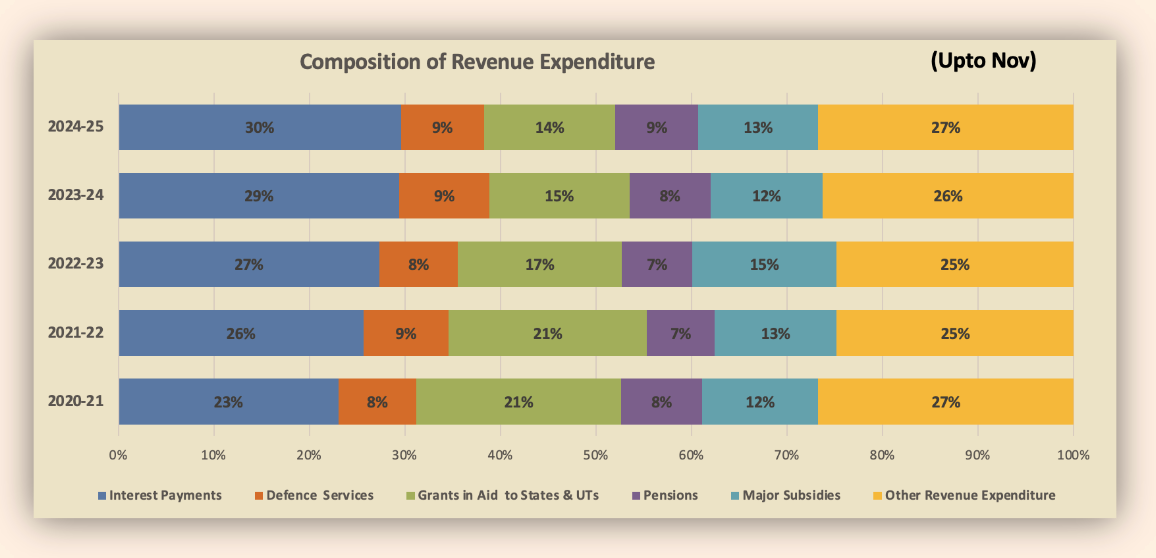

As evident in chart below, the government’s current spend on ‘interest expenditure’ is already too high at about 30% of its total revenue expenditure (i.e. recurring expenditures) as of Nov 2024.

There’s a lot of scope to reduce this expenditure going forward, and the government has its head in the right place. High debt also increases the broader interest rates in the economy because when the government approaches the market to borrow funds, the net amount of funds available in the market for the ‘private sector’ to borrow reduce.

In other words, even though there’s high demand for funds in the market (from the government as well as the private sector), the supply of funds (from lenders) is limited — the only way to increase this supply of funds is to pay higher interest rates to lenders. Doing this bumps up the interest rates across the economy, leading to a squeeze in borrowing as well as spending. This slowdown in borrowing then trickles down into the demand for goods and services in the economy, and by extension also GDP growth.

So reducing fiscal deficit is crucial. If you are a nerd (like me), this paper by C. Rangarajan and D.K. Srivastava about the impact of deficits on the economy may interest you.

Before moving further, I suggest you download (and track with me) the Union Budget’s data provided in the Excel sheet below: