In this post, I argue that India’s equity market, particularly as represented by the Nifty 50, is not in overvalued territory yet. Yes, a 12-18% correction is normal, healthy and also desired. But there’s absolutely no reason to fear a crash — unless a major exogenous event such as a pandemic or a geopolitical conflict takes place.

Why do I say that? Well…

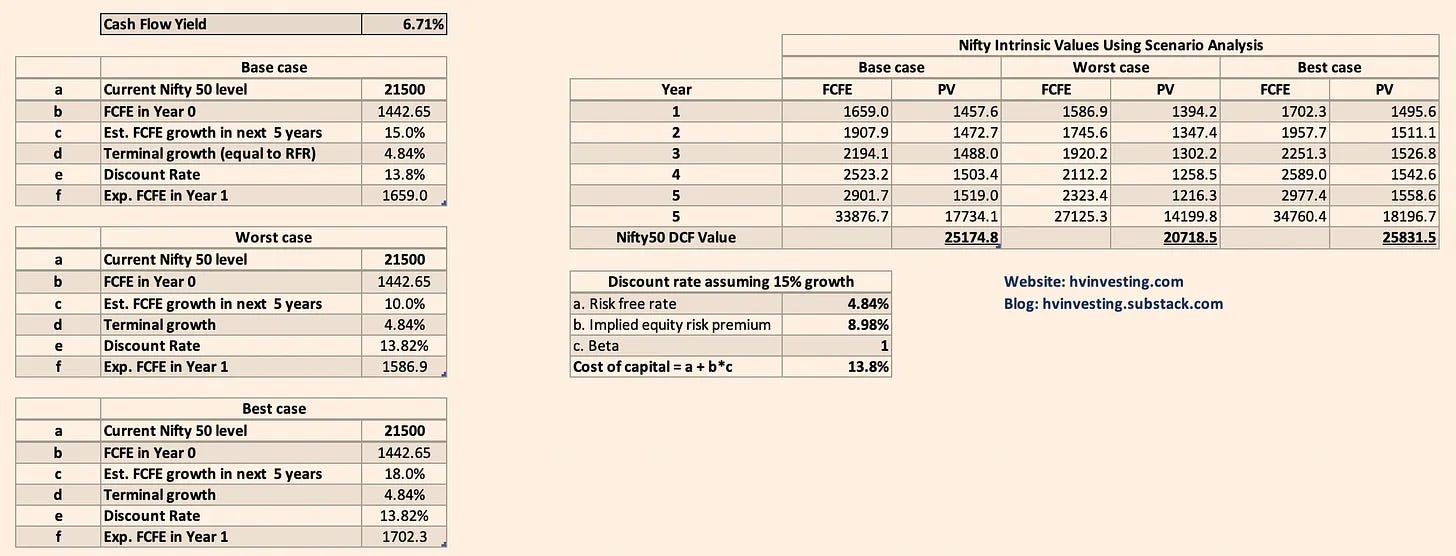

If you remember, in January this year I’d valued Nifty 50 using discounted cash flow (DCF) method and suggested that Nifty’s intrinsic value in the base case scenario was 25174. Not surprisingly, the index hit this level in recent weeks. In the best case, I argued, Nifty’s value should be 25800, which is still some points away. But that’s the best case, of course. And worst case was 20,000.

You may access the DCF model of Nifty 50 here.

Here’s a screenshot for you:

While I am currently working on an updated model that accounts for the revised risk premium of India’s equity market, let us take a quick look at Nifty’s relative valuation metrics.

As you may notice below, these metrics also hint at reasonable valuation (not very expensive) of Indian markets: