BPCL Valuation, Part 2: Reinvestment, Capex, and Capital Efficiency

I analyze how much BPCL needs to reinvest across refining, petrochemicals, and green energy, and whether those investments will create shareholder value

In Part 1 of this BPCL valuation series, we broke down the company’s business into four key segments: refining, fuel marketing, petrochemicals, and green energy. We then built a 10-year revenue and EBIT forecast for each. We projected how BPCL’s refining throughput would grow with the Bina project expansion, how marketing volumes would rise with network expansion, how petrochemicals would become the highest-margin business over time, and how green energy would begin contributing meaningfully post-FY2028.

The numbers told a clear story: BPCL is in the middle of a once-in-a-decade transformation. To be sure, this transformation is not radical, but more of a survival strategy to adapt to the green energy transition that the world is currently undergoing.

Now… remember that revenue growth alone does not create value. A company must invest to grow, and the quality of those investments determines whether shareholders actually benefit.

In Part 2, we turn our attention to reinvestment and capital efficiency.

Here's what we’ll cover in this part:

How much BPCL will need to reinvest over the next 10 years to achieve the growth forecast in Part 1?

Capex forecasts by segment, including refining, petrochemicals, marketing, and renewables

The sales-to-capital ratio and what it tells us about the capital intensity of BPCL’s business.

How BPCL’s Return on Invested Capital (ROIC) is expected to evolve

Whether ROIC is likely to exceed the company’s cost of capital, and if so, by how much.

By the end of this part, we will know whether BPCL’s growth is likely to be value-accretive or capital-destructive, and how that shapes the assumptions we use in our final valuation.

Let’s dive in

In Part 1, we estimated BPCL’s revenue from all four segments i.e. refining, marketing, petrochemicals, and green energy. Here’s BPCL’s total revenue from all segments combined:

Now . . . to drive revenue and operating profit growth, BPCL must continually reinvest capital, isn’t it? If it doesn't, the revenue wouldn’t grow.

I estimate annual reinvestment (capex and net working capital changes) over the next 10 years based on an “incremental sales to capital ratio” approach (the inverse of the capital turnover). This ratio tells us how many rupees of additional revenue are generated per rupee of additional capital invested.

BPCL’s historical capital efficiency is mixed: being in a high-revenue industry (due to oil prices), its sales-to-capital is high in nominal terms, but this is not a true efficiency measure since much of revenue is pass-through cost of crude.

A better gauge is capacity additions vs. capex. For instance, BPCL’s upcoming Bina expansion (see below) will cost ₹49,000 Cr and eventually add perhaps ~₹40,000 Cr in annual revenue (as I forecast ~₹21k Cr from petchem + ~₹15k Cr from refining by 2030). How did I arrive at this estimate?

What We Know: Bina Expansion Project (as disclosed by BPCL)

Total Capex: ₹49,000 crore

Scope: Expanding Bina refinery capacity from 7.8 MMTPA to 11 MMTPA (+3.2 MMTPA refining). Adding an integrated petrochemical complex (ethylene cracker + downstream polymer units). Commissioning expected between FY2028–FY2029.

Now, from our Part 1 forecast:

We estimated BPCL’s petchem sales to grow from ~₹2400 cr to ₹26,100 cr by FY2034, with the Bina cracker driving the jump after FY2029 (see table below).

By FY2030, petrochemical volume is estimated at ~2.5 MMT, at an average realization of ₹85,000 per ton.

So, 2.5 MMT × ₹85,000/ton × 100 = ₹21,250 crore

This means petchem revenue from Bina is expected to reach around ₹21,000–22,000 cr annually once fully ramped up.

Note again that this is only petrochemicals revenue. But the Bina project also involves 3.2+ MMT per annum of addition to BPCL’s refining capacity. So how much does this add to BPCL’s revenue from refinery operations?

If we assume 100% utilisation of this capacity and average realization of ₹6,500 per barrel (based on Brent crude at ~$75 and INR at 85):

Then, we can convert 3.2 MMT to barrels:

3.2 MMT × 7.33 barrels/ton= 23.46 million barrels/year, assuming 1 MMT = 1,000,000 tonnes

Now . . . 23.46 million barrels × ₹6,500 = ₹15,250 cr/year

Rounded: ~₹15,000 cr in additional annual fuel revenue from the expanded refining.

So, the Bina project capex will add petchem revenue of 21000 crore and refining revenue of 15000 crore per year. This implies roughly ₹0.8 of incremental revenue per ₹1 of capex, or conversely an incremental capital/revenue ratio ~1.25x for that project.

I will use this as a baseline for refining/petchem investments. Marketing investments (like new fuel stations) typically have higher sales-to-capital (because a petrol pump doesn’t add much fixed cost but sells a lot of fuel), whereas renewables have lower (a rupee of capex yields perhaps ₹0.2 of revenue annually given tariffs).

So I refine the ratio by segment:

Refining/Petchem Reinvestment: Large lump-sum projects. I assume ₹1 of capex yields ~₹0.8 of new revenue (sales-to-capital ~0.8). This is reflected in the Bina project and is typical for complex refineries (which cost $15k+ per bbl/day capacity). I allocate the known capex for Bina: about ₹16,000 Cr in FY2025 and ₹18,000 Cr in FY2026 (company guidance, largely Bina-related), then heavier spending of ~₹30,000 Cr in FY2027 when the bulk of Bina project outlay occurs. After FY2028, I assume refining capex tapers off (with Bina done, only maintenance and de-bottlenecking, say ₹5,000 Cr/year).

Marketing Reinvestment: BPCL has been expanding its retail network and infrastructure (depots, pipelines). I assume an incremental sales-to-capital ratio ~2.0 for marketing (₹1 of capex yields ₹2 of revenue growth), reflecting relatively lower capital intensity. Given our marketing volume growth of 10 MMT over 10 years (₹1.2k cr revenue increase), I allocate ~₹45k Cr of capex over the decade to marketing. This includes new retail outlets, pipeline projects, and modernization of existing outlets (e.g. adding EV chargers, convenience stores). In early years, marketing capex may be around ₹2,000–3,000 Cr/year (BPCL commissioned 540 new outlets in H1 FY25, indicating significant ongoing spend).

Petchem Reinvestment: Included in refining for Bina, but if BPCL pursues additional petrochemical projects (e.g. specialty chemicals), I assume they are within the ₹1.7 lakh Cr capex plan already mentioned. No separate major petchem capex beyond Bina is assumed in this 10-year frame.

Green/Renewable Reinvestment: These are upfront-heavy. I use sales-to-capital ~0.2 (since ₹10,000 Cr yields ~₹2,000 Cr revenue at maturity as seen in our forecast). BPCL has earmarked ₹10,000 Cr over FY25–27 for renewables. Beyond that, to reach 3+ GW by 2034, I assume another ~₹10,000 cr over FY28–FY34 (on average ₹1,500 cr/yr).

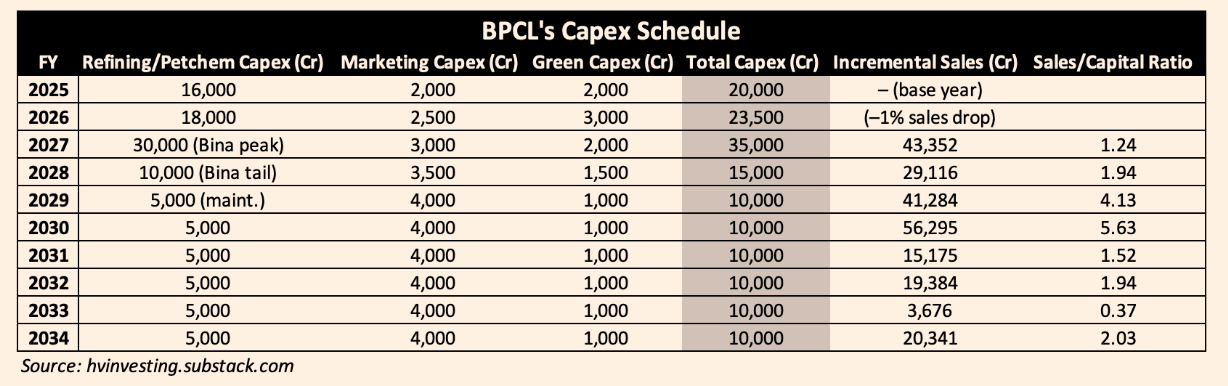

The table below summarizes the projected reinvestment (capex) by year and segment, and the implied sales-to-capital efficiency:

Notes: FY2025–26 capex per ICRA estimates.. “Incremental Sales” is year-over-year revenue change from Part 1 forecasts (can be negative if price drops, e.g. FY26 sees lower sales due to Brent drop). Thus, sales/capex ratio fluctuates. Over the full decade, total capex ~₹1,53,500 Cr yields revenue growth from ~₹4.6L cr to ₹6.8L Cr (₹2.2L cr increase), giving an average Sales/Capital ~1.46.

The above schedule indicates heavy front-loaded capex (FY25–28) for the refinery expansion and renewables, followed by mostly maintenance capex. BPCL’s own plan aligns: management indicated a 5-year capex of ~₹1.5 lakh cr (which our 10-year ~₹1.54 lakh cr capex roughly matches in present value).

They also mentioned potentially ₹1.7 lakh cr in projects aspirationally, which likely includes a possible new refinery (a greenfield in Andhra Pradesh was hinted) – I have not explicitly included a new refinery beyond Bina, so if that happens post-2030, it would be upside to volumes but also require more capex.

Capital Efficiency Analysis: The effective capital turnover (Revenue/Invested Capital) for BPCL is high due to the nature of oil marketing. In FY2025, BPCL had ₹4.68 lakh crore of revenue (see first table) on a capital employed of perhaps ~₹1.2 lakh crore (book value of equity ₹80k Cr plus debt ~₹43k Cr) – implying ~3.9x revenue/capital. This is not efficiency per se, but reflects that a lot of revenue is raw material pass-through. What do I mean by that?

When comparing revenue to capital employed (as we did above), BPCL’s revenue looks huge (see the first table) i.e. ₹4.68 lakh crores in FY2025.

But much of that revenue is just the cost of crude oil and fuels sold, which BPCL had to buy first. It doesn't mean BPCL is generating equally large returns on capital.

A better metric is ROIC (Return on Invested Capital).

I calculate ROIC = NOPAT / (Operating Invested Capital). Historically, BPCL’s ROIC has been volatile: in lean years like FY2023, NOPAT was near zero, so ROIC ~0%. In strong years (e.g. FY2022 or FY2016), ROIC could exceed 15%.

Using FY2025 as a proxy: EBIT was roughly ₹<15k cr (estimated from our segment analysis), and invested capital (net of cash/investments) might be around ₹1,20,000 cr, so ROIC ~ 9.3% (EBIT ₹15k – 25% tax = ₹11.2k NOPAT; ₹11.2k/₹1,20k = 9.3%). On a consolidated basis, I estimate FY2025 ROIC in the low double digits, thanks to the recovery in marketing margins and inventory gains.

Going forward, if BPCL achieves our forecast margins, by FY2030 EBIT could be ~₹34k cr, and if invested capital by then is ~₹2 lakh cr, NOPAT/Capital ~11.5% ROIC.

I compare this to the cost of capital (WACC) in Part 3 to gauge value creation. In general:

Refining ROIC: Typically cyclical and around or slightly above cost of capital over a cycle. High capex projects like Bina need to earn robust margins to justify the spend. BPCL’s integrated project is expected to yield ~15% IRR as per industry standards, which would translate to low-teens ROIC once stabilized – which should clear the hurdle rate if executed well.

Marketing ROIC: Very high on a stand-alone basis (since little fixed capital is needed; the main “capital” is working capital for inventory). This segment, when not politically constrained, generates strong cash returns (it’s essentially a turnover business). That’s why years like FY2022 saw PSU OMCs with good ROIC. My forecast assumes normal conditions, so marketing will continue to be a cash cow requiring moderate growth capex (new stations) but yielding >20% returns on that incremental investment (e.g. a new fuel station might cost a few crore to set up but can generate tens of crores in revenue annually).

Petchem ROIC: Initially lower (huge Bina capex upfront), but once at scale, should be decent. If petchem EBIT margins ~15%, asset turns maybe ~0.5 (revenue/capital), that gives ~7.5% ROIC on petchem assets; however, many petchem assets last long and improve over time. I expect BPCL’s petchem push to slightly dilute ROIC in the build-up phase (due to the massive capital outlay), but by 2030 it should accretively raise overall ROIC because of high margins and volume.

Green ROIC: Likely below BPCL’s average, at least initially. Renewable projects in India often have IRRs of 8–10%. I assumed a 30% EBIT margin on a modest revenue base – that might yield ~5–6% ROIC on the green capital (since asset turnover ~0.2, margin 30%, ROIC ~0.06). This is a strategic investment area, possibly subsidized or incentivized, so BPCL may accept lower returns here for strategic positioning (and to align with ESG goals).

Overall, BPCL’s ROIC vs WACC will determine value creation. I anticipate ROIC will exceed WACC slightly in the mid/late forecast (which creates value), whereas in the recent past BPCL’s ROIC dipped below WACC during periods of price intervention (destroying value).

My projections show ROIC ~11–12% by 2030, which if WACC is around ~8.8% (see Part 3) implies modest value creation. I will explicitly compare these in Part 3 and Part 4. Notably, government-owned OMCs historically have struggled to consistently earn above their cost of capital due to regulated pricing phases, but with mostly deregulated fuels and diversification, BPCL has a chance to buck that trend if it executes efficiently.

Coming up next: Valuing BPCL’s cash flows

In Part 3, I’ll:

Estimate BPCL’s Weighted Average Cost of Capital (WACC) using market-based inputs.

Project Free Cash Flows to the Firm (FCFF) over 10 years using our segment-wise forecasts.

Compute BPCL’s intrinsic value per share using a full DCF model.

And yes — I’ll give you the full Excel model, so you can explore and test it yourself.

Also, for now . . . you can find the schedules (tables) that I have discuss till now, including assumptions, in the Excel file below. Specifically, this file includes BPCL’s revenues (combined but also from all 4 segments separately), EBIT, and capex schedule: